What does 'going digital' really mean for pension funds?

James King,

, Pippa Rudling

LTAFs: The silver bullet the DC market has been waiting for?

SHARE

Private market asset classes have historically been the domain of Defined Benefit schemes. We have seen a huge campaign in recent years, with a multitude of publications and conference sessions, about “patient DC” and productive finance – because Defined Contribution members should have access to the same tools as DB. They should be able to reap the potential benefits of private markets, such as capturing the illiquidity premium. The Government would also desperately like pension schemes to direct more of their capital into projects to help grow the UK economy.

If it becomes easier for DC schemes to invest in private market asset classes, then it’s a tremendous way to unlock a huge source of funds. The Long-term Asset Fund (LTAF) offers one such solution.

The LTAF is a new form of FCA-authorised open-ended investment fund, which is able to invest in a range of long-term illiquid assets. LTAFs have greater flexibility in their investment powers compared to other types of authorised fund, for example their exemption from permitted links rules for life funds. This additional flexibility is balanced by placing other stringent requirements on the fund manager and depositary of the LTAF. Given this flexibility, it is clear that there is no ‘one size fits all’ when it comes to this new fund regulation.

AMX by Carne recently ran a seminar for an audience of DC investment consultants, on this topic, with panellists Catriona Buckley from Gresham House, Stefanie Sahla-Jones from Eversheds Sutherland and Des Fullam from Carne Group. A summary of the discussion follows here.

Given the nascency of the LTAF, the private markets manager needs to work closely with the scheme or master trust trustees and their investment consultant in the fund design phase. The role of the life platforms is also critical, given the role they play when it comes to operational efficiency, and they should be included in early fund design conversations.

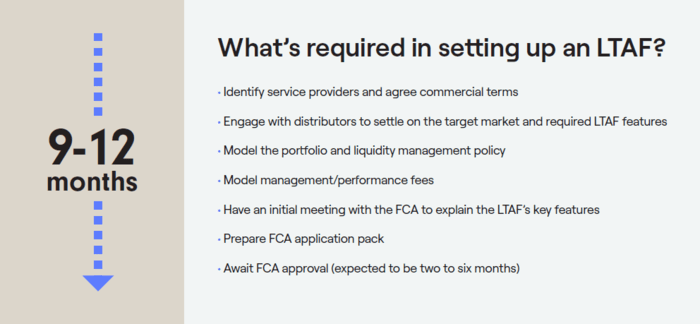

Early engagement with the FCA is imperative. The LTAF will be one component of the scheme or master trust’s overall investment strategy, and the FCA will want visibility of this in order to assess the viability of any new fund. The FCA will also require a model portfolio to facilitate discussion about liquidity management and fees. Therefore, stakeholder collaboration is critical. (See liquidity section).

Note: This checklist is a component of the overall investment strategy and impacts how the LTAF will be structured.

Shifting the focus from cost to value

Fees are always a key consideration but even more so in the DC world. The charge cap is often cited as a reason “not to do private markets” for DC as fees and expenses are typically higher than in other asset classes (due in part to the ownership structure, active engagement and value creation initiatives within private markets). The relaxation in the most recent FCA consultation to exclude performance related fees from the charge cap is helpful. However, even with this relaxation, there may be some reluctance in the market to pay the fees typically applicable in private market funds.

The recent publication from the Productive Finance Working Group highlighted the steps they have been taking in shifting the focus from minimising costs to a more comprehensive value assessment for members. As member engagement increases, allocation to private market assets such as social infrastructure, and sustainably focused strategies such as renewable energy and carbon capture will empower members to focus more on outcomes rather than costs.

Given the potential upside that a meaningful private markets allocation can make, it shouldn’t be a reason not to consider allocating to an LTAF if it is right for the scheme’s objectives and we will likely see some master trusts make it work.

Working with platforms

One of the frequently cited reasons for DC investors being unable to invest in private markets, is the fact that the DC platforms have historically required funds to offer daily-dealing.

At a minimum, the LTAF offers monthly dealing, which adds a degree of operational complexity. That said, some platforms are leading the way and are at the forefront when it comes to innovation. At AMX, we see collaboration with the DC platforms as crucial to the success of the LTAF. Whilst AMX can offer robust fund structures and fulfil the responsibility of the AIFM, any DC scheme would rely on the administrative capabilities of their chosen life platform. As such, AMX can assist with the connectivity between the actual LTAF and the DC scheme via the life platform.

The complexity of liquidity

Managing liquidity is one of the biggest operational challenges when it comes to investing in private markets, and this is magnified for DC schemes. Much focus is placed on fund liquidity in order to manage flows, however, given that the LTAF would represent a small portion of the overall scheme’s portfolio, liquidity management at the scheme level is equally significant. As such, we believe private market specialists can continue investing in the same manner they do for non-DC scheme investors. In other words, with true exposure to long-term and illiquid assets, rather than having to offer liquidity sleeves within their funds.

Default arrangements are likely to have strong, predictable cashflows and significant holdings of liquid assets, thus making it easier to reconcile at a scheme level. That said it is important for DC schemes’ decision makers to understand the key features of the fund-level liquidity management, in order to become comfortable with investing in such funds.

Given the incredibly long-term nature of DC investments, and the lack of churn typically seen in a default strategy, redemptions are unlikely to be problematic. Instead, it’s the quantum of inflows which will be harder to manage, given the exponential growth that master trusts are seeing. A typical private markets solution would have good visibility of when transactions will open and would communicate with their clients about calling capital, with a drawdown notice of 10 days as standard. The approach is potentially different for DC, and so it is important for all stakeholders to agree the best approach prior to fund launch.

LTAFs are open-ended, however they do incorporate certain features such as minimum notice and redemption periods (typically a 90-day minimum), in order to align the fund structure with the illiquidity of the underlying assets and to protect the interests of the end investors. Given the potential complexity in this alignment, DC schemes’ trustees and consultants should ascertain that the fund managers can demonstrate how they will manage this.

There is no “one size fits all” way of structuring the liquidity management of a less liquid fund. The approach will depend on the assets, the investment strategy and the profile and needs of investors. As we emphasise, collaboration between all stakeholders is paramount.

Valuations – how stale is too stale?

The FCA has stated that they require monthly valuations. However, when the underlying assets are typically valued on an annual basis, this creates a misalignment and the risk of very stale valuations. Going back to the collaboration point, in the fund design phase a clear framework needs to be put in place to ensure the asset manager, AIFM (if different) and end investor(s) are in agreement about the best approach, the role of external valuers and how comfortable they are with using indicative valuations.

LTAFs – a future opportunity?

The LTAF offers an exciting opportunity for the UK pension industry. Although progress has been slow – the LTAF was first authorised in November 2021 andwe anticipate that we will see the first fund launches in early 2023. Again, making the point about its nascency, conversations with the FCA will be lengthy as it’s imperative that, as an industry, we get this right.

It will require education and perhaps a mind-set shift for some trustees. These things take time and whilst we’re likely to see some innovative master trusts wanting to be seen to be first movers, we don’t anticipate seeing huge allocations to LTAFs in the early years.

That said, we’re potentially at a ‘watershed moment.’ The UK DC market is predicted to grow to £1 trillion by 2030*, and if private markets can make up even a small portion of that, then the opportunities – for DC investors as well as the UK economy – are potentially huge.

What does 'going digital' really mean for pension funds?

James King,

Video: Five questions with Maple-Brown Abbott

Article,